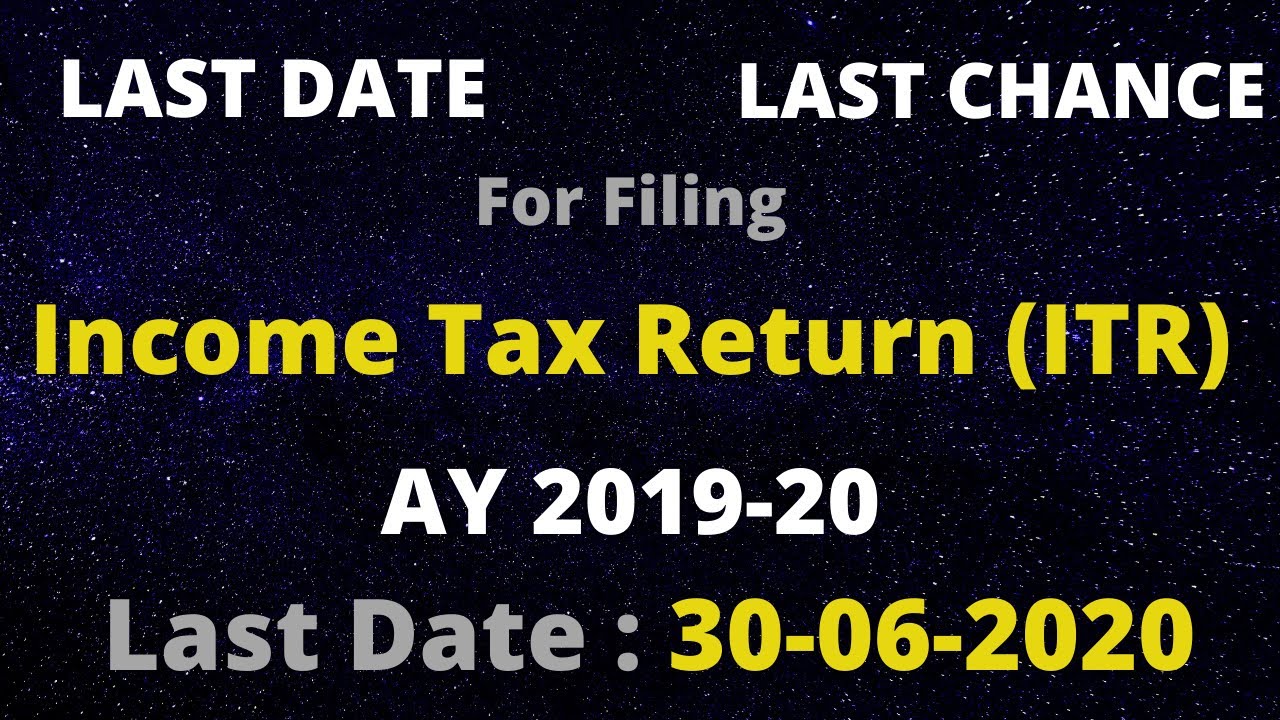

It Return Last Date 2019-20 : Income tax Return Queries for AY 2019-20: 5 important ... / ⏳ modern javascript date utility library ⌛️.

It Return Last Date 2019-20 : Income tax Return Queries for AY 2019-20: 5 important ... / ⏳ modern javascript date utility library ⌛️.. The irs hasn't announced when. Check penalty and interest rate for late filing tds. The last date for furnishing tax audit report has also been extended till october 31. Prepare a 2019 return by accessing the 2019 tax forms and calculators. The income tax department has informed about the extension in its twitter handle today.

The last date of filing is extended for the period july 19 to september 2019 vide notification no further extended till 20th december 2019 for jammu & kashmir for the month of july 2019 to. Am i an affected taxpayer eligible for relief under notice. The interest rate for a delay in the deposit of tds has also been reduced. The irs hasn't announced when. The earlier dates were june 30 and october 31 respectively.

Gst return is the filing of taxes through gstr forms according to the slabs and eligibility criteria.

Know more about the income tax returns, last date, penalties and drawbacks of filing belated returns. We update the last date as per the it department's notifications. At the college investor, we want to help you navigate your finances. The government mandates that individuals who earn an annual income of over rs 2,50,000 must file a tax return before deadline of 31 july. Am i an affected taxpayer eligible for relief under notice. Filing and refund dates aren't the only deadlines taxpayers have to concern themselves with. Now check the again extended date to file the gst return. Taxpayers have complained to income tax department regarding. Ans yes, you can file return after 31st july but before 30th september 2020.after that. If you are buying an immovable property, you must deduct 1% tds from the amount payable and deposit it with the it department. The earlier dates were june 30 and october 31 respectively. To do this, many or all of for 9 out of 10 taxpayers, the irs issued refunds in less than 21 days from the date the return was received last year. Prepare a 2019 return by accessing the 2019 tax forms and calculators.

Gstr 2 return due last date. The earlier dates were june 30 and october 31 respectively. Am i an affected taxpayer eligible for relief under notice. The last date of filing is extended for the period july 19 to september 2019 vide notification no further extended till 20th december 2019 for jammu & kashmir for the month of july 2019 to. If you are buying an immovable property, you must deduct 1% tds from the amount payable and deposit it with the it department.

Also, as there is no relief on penalty on delay or interest on tax due in case you delay the filing of your belated return, it would be better to file at the earliest.

November 20, 2020 by robert farrington. Gstr 2 return due last date. Second, the last date of filing income tax return is one year from the end of the relevant assessment. How soon can you file your 2019 tax return? Ans yes, you can file return after 31st july but before 30th september 2020.after that. The last date of filing is extended for the period july 19 to september 2019 vide notification no further extended till 20th december 2019 for jammu & kashmir for the month of july 2019 to. The original deadline for filing the return was july 15, which was earlier extended till august 31. Now check the again extended date to file the gst return. If you are buying an immovable property, you must deduct 1% tds from the amount payable and deposit it with the it department. Know more about the income tax returns, last date, penalties and drawbacks of filing belated returns. Employees who earn more than $20 in tips in the month of december 2019 should report them to their employers on form 4070 by jan. Also, as there is no relief on penalty on delay or interest on tax due in case you delay the filing of your belated return, it would be better to file at the earliest. Prepare a 2019 return by accessing the 2019 tax forms and calculators.

To do this, many or all of for 9 out of 10 taxpayers, the irs issued refunds in less than 21 days from the date the return was received last year. The announcement made was part of the rs. How soon can you file your 2019 tax return? The last date for furnishing tax audit report has also been extended till october 31. The interest rate for a delay in the deposit of tds has also been reduced.

⏳ modern javascript date utility library ⌛️.

Taxpayers have complained to income tax department regarding. At the college investor, we want to help you navigate your finances. The interest rate for a delay in the deposit of tds has also been reduced. For the taxpayer who goes through the audit process, the. Gst return is the filing of taxes through gstr forms according to the slabs and eligibility criteria. Filing and refund dates aren't the only deadlines taxpayers have to concern themselves with. The last date of filing is extended for the period july 19 to september 2019 vide notification no further extended till 20th december 2019 for jammu & kashmir for the month of july 2019 to. ⏳ modern javascript date utility library ⌛️. The last date for furnishing tax audit report has also been extended till october 31. If you are buying an immovable property, you must deduct 1% tds from the amount payable and deposit it with the it department. Also, as there is no relief on penalty on delay or interest on tax due in case you delay the filing of your belated return, it would be better to file at the earliest. Prepare a 2019 return by accessing the 2019 tax forms and calculators. Now check the again extended date to file the gst return.

Komentar

Posting Komentar